A Responsible Reasonable and Targeted Budget.

Treasurer Jim Chalmers has handed down his first budget – one that is set in the midst of a pandemic, natural disasters, global volatility, and a rising cost of living.

The challenges facing Australia and growing – are unprecedented floods, substantial global economic slowdown, high inflation, low wage growth, rising interest rates and inherited debt. The Treasurer talked of restraint within the budget and taking hard decisions for hard times – but that this is a first step budget.

This budget primarily focuses on developing a platform for more substantial changes in the economy over the next few years, as opposed to any major reforms in the near term. Given the elevated cost of living, most policies presented in this budget aim to provide relief for households with the intention of limiting any additional momentum to inflationary pressures.

The budget position has improved compared to Treasury’s forecast in March. A combination of a tight labour market, high commodity prices, and a strong rebound in economic activity compared to last year sees the budget deficit declining to $37 billion in 2023 before a modest uptick over the next few years.

Below is a summary of the changes;

Superannuation

- The Government is proposing to lower the age for downsizer contributions from 60 to 55. Downsizer contributions don’t count towards your non-concessional contribution (after-tax) cap so if you’re eligible and under 75, a couple could potentially contribute $660,000 into their super by bringing forward three years’ worth of after-tax contributions in addition to the $600,000 that can be contributed upon the sale of their home.

- Self-Managed Super Fund (SMSF) members will have greater flexibility to retain and contribute to their fund while being temporarily overseas.

Taxation

- No extension of the low- and middle-income tax offset that ceased from 30 June 2022.

- No extension of the previous cuts made to fuel excise tariffs ceased to apply on 29 September 2022.

- For those looking to salary package a motor vehicle as part of their employment, there will be exemptions from fringe benefits tax for certain electric vehicles packaged on or after 1 July 2022.

Stage three tax cuts are still set to go ahead as per below:

Social Security

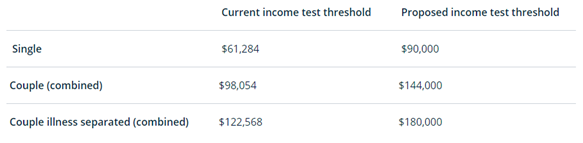

The Government is increasing the income test threshold for the Commonwealth Seniors Health Card as per below:

Pensioners are encouraged to continue participating in the workforce by:

- Temporarily increasing the Work Bonus income bank;

- Having an extra $4,000 credited to their Work Bonus income concession bank balance, with the maximum balance increasing from $7,800 to $11,800 until 30 June 2023.

- The income bank offsets future income from work that would otherwise be assessable under the pension income test.

- The existing Work Bonus concession of $300 per fortnight will remain unchanged.

- Extending the qualification period for Pensioner Concession Cards;

- Working pensioners will be able to keep their Pensioner Concession Card for up to two years after their pension stops.

- Suspending, instead of cancelling, benefits and entitlements for up to two years;

- If pensioners lose their entitlements due to increased income from work, they and their partners will be able to start receiving their pension again more easily if their situation changes.

- The Government is aiming to reduce the financial impact on pensioners looking to downsize their homes and help free up housing stock for younger families by:

- Extending the social security assets test exemption for principal home sale proceeds from 12 months to 24 months for income support recipients.

- Amending the social security income test, to apply only the lower deeming rate (currently 0.25%) to principal home sale proceeds when calculating deemed income for up to 24 months after the sale.

- In some circumstances, the measures can extend for a further 12 months (up to 3 years in total) on approval.

- The Government will freeze social security deeming rates at their current levels until 30 June 2024 to provide some certainty on how investment income is assessed in an environment of rising interest rates. The lower deeming rate will remain at 0.25% and the upper rate will remain at 2.25%.

- The Government will reduce the maximum general co-payment for medications on the Pharmaceutical Benefits Scheme (PBS) from $42.50 to $30 per script. This will support people who have a high demand for prescription medicines due to their health needs.

Families

- The Government is proposing to give families access to more leave and greater flexibility by:

- Combining Parental Leave Pay and Dad and Partner Pay into a single 20-week payment.

- Introducing a family income limit of $350,000.

- Enabling either parent to claim the payment.

- Allowing eligible birth parents and non-birth parents to receive the payment.

- Allowing parents to take leave at the same time while claiming the payment.

- From 1 July 2024, the Government will start expanding the scheme by two weeks a year until it reaches a full 26 weeks from 1 July 2026. Both parents will be able to share the leave entitlement on a ‘use it or lose it’ basis and single parents will be able to access all 26 weeks. Paid parental leave will be able to be taken in blocks as small as a day at a time between periods of paid work.

- The Government aims to ease the cost of living for families and reduce barriers to workforce participation by:

- Increasing the maximum Child Care Subsidy (CCS) rate from 85% to 90% for families earning less than $80,000.

- Increasing the CCS rate for families earning less than $530,000 in household income.

- Maintaining higher CCS rates (up to 95%) for families with more than one child aged five and under in care.

Aged Care

- The Government is increasing funding to reform aged care by:

- Establishing an aged care complaints commissioner, introducing new financial reporting requirements, supporting the sector in providing better food for residential and home care recipients and establishing a national registration and code of conduct for workers.

- Capping administration and management fees in the Home Care Packages Program and abolishing exit fees.

- Requiring all facilities to have a registered nurse onsite 24 hours per day, 7 days a week from 1 July 2023 and increasing care minutes to 215 minutes per resident per day from 1 October 2024.

- Improving aged care infrastructure and services that support older First Nations people and older Australians from diverse communities and regional areas.

Summary

This is a budget that lays out the current status of the economy and funds some areas of the government’s election promises. However, this is a “first-step” budget – it is setting the scene for what happens in March.

The biggest winner in this budget is the federal purse – the windfall commodities $150B has gone straight off the bottom line deficit. As for losers – the cost of living increases with no real increase in wages for 18 months will affect everyone.

Businesses will need to brace for ongoing wage growth, further inflationary pressures, a slowing economy, and for interest rate increases.

It’s a complex balancing act.

For more information or if you have any questions about your personal situation, contact our office on (08) 8172 9111 or email our friendly team today!